The Great Luxury Designer Reshuffle: Survival Strategies in an Age of Splintering Consumers

- Oct 7, 2025

- 9 min read

Image: Dior Spring-Summer 2026 fashion show by Jonathan Anderson

If the recent carousel of creative director appointments feels dizzying, it’s because we are not merely witnessing a changing of the guard. We are watching an entire industry—one built on dreams and desire—confront a harsh new reality. The global luxury sector is in the throes of a perfect storm, and the frantic musical chairs are merely the most visible symptom of a deep, systemic crisis.

This reckoning is fueled by a triple threat: vanished tailwinds, a broken business model, and a consumer revolution.

The Three Pillars of the Crisis:

The Macroeconomic Squeeze: The End of the "Easy Money" Era

The luxury industry enjoyed a massive sugar rush post-pandemic, with a record 22% surge in 2022. That party is over.

The Great Slowdown: The market contracted by 1.6% in 2024. We've moved from double-digit growth to a projected, more sober 4% for 2025. The era of effortless, industry-wide growth is finished. Now, growth for one brand must come at the expense of another.

The China Conundrum: The initial engine of luxury growth for the past decade has sputtered. China's economic slowdown and property crisis have shattered consumer confidence. Critically, Chinese shoppers now prioritize the "here and now" over heritage. They buy the current "it" bag, not a brand's 100-year history. This makes every collection a make-or-break moment and reduces brand loyalty.

Geopolitical Pressures & Inflation: Rising U.S. tariffs and global uncertainty are squeezing operations and costs. More importantly, Bain & Company's finding that surging prices have driven away 50 million high-end consumers is a deafening alarm bell. The industry's relentless price hikes have hit a wall, exposing a value perception crisis.

The Industrial Shift: A Broken Business Model

The very system that built these mega-brands is now working against them.

The "Superstar Designer" Trap: Over the last two decades, the industry built a model around a single, charismatic creative director who could define a brand's world. But this created a massive single point of failure. When that designer's vision fades from fashion, the entire brand stumbles. We became addicted to a cycle of revolutionary creative geniuses, which is unsustainable.

The Conglomerate Profit Machine vs. Creative Patience: Publicly traded conglomerates like Kering (Gucci) and LVMH (Dior) are beholden to quarterly results. The financial markets have zero patience for a multi-year, gentle brand evolution. When a brand like Gucci shows a revenue decline under De Sarno, the pressure from investors is immense, leading to a panicked, swift change in leadership. The stock price is now a direct and immediate report card on a designer's first collection.

The Innovation Stagnation: Beneath the surface of marketing glitz, many brands have suffered from a lack of genuine product innovation and an over-reliance on legacy silhouettes. Coupled with a flood of similar choices in the market, this has created consumer fatigue. The failure to offer compelling newness and unclear brand identities has resulted in weak value propositions, making the drastic price hikes feel unjustified and driving the value perception crisis.

The Splintering Consumer & The Identity Crisis

Brands have lost sight of who their customers are. The market has fragmented. There's no longer one monolithic "luxury consumer."

The Old Guard wants heritage and continuity ( the Hermes, Chanel consumer)

The Younger Hypebeast wants viral moments and attitude (the Demna consumer).

The Intellectual Shopper wants storytelling and artistry (the Anderson consumer).

The "Quiet Luxury" adherent wants understated quality and timelessness.(the Loro Piana consumer)

Trying to be all things to all people is a recipe for failure. The brands with the strongest, clearest DNA (like Chanel and Hermès) are weathering the storm. The ones in transition are desperately trying to pick which customer segment to bet on.

The "unprecedented wave" of changes is a direct symptom of an industry grappling with a new reality. The economic tailwinds are gone, the consumer is more powerful and discerning than ever, and the conglomerate structure demands instant results.

Appointing a new creative director is now the fastest lever a CEO can pull to signal a strategic shift to the market. It's a cultural and financial signal far more than a purely creative one. The winners in this new era won't be the brands with the most viral shows, but the ones who can align a compelling creative vision with a sustainable business model that a specific, well-defined customer is actually willing to pay for at full price. The age of the monolithic luxury giant is over; the age of the focused, intelligent luxury house has begun.

Image: Burberry 2026 Spring-Summer fashion show by Daniel Lee

The Chinese Luxury Consumer: A Realm of Paradoxes and Power

The narrative of the free-spending Chinese shopper blindly buying logos is dangerously outdated. The modern Chinese luxury consumer is a complex, sophisticated, and powerful force defined by several key characteristics:

The "Here and Now" Mentality (The Most Critical Shift)

For Chinese shoppers, the "here and now" of a brand's design is more important than its historical context. This is a seismic shift from Western consumption patterns.

Why? China's rapid economic rise means there is less intergenerational wealth and a weaker cultural connection to European "heritage." A brand's 150-year history is an abstract concept; a viral handbag on Rednote is a tangible, immediate social asset.

This creates extreme volatility. A brand is only as hot as its last collection. There is no long-term loyalty built on legacy. This puts immense pressure on creative directors to constantly deliver novelty and "hit products" that capture the current mood.

The Rise of the "Professional Consumer"

Chinese consumers are arguably the most educated and research-driven in the world. Before buying a $5,000 bag, they will most likely search on Rednote for countless reviews, outfit inspirations, watch detailed analysis and "unboxing" videos on Douyin (the Chinese TikTok).

Compare prices globally and understand the nuances of quality and craftsmanship, with their expert-level research, is particularly adept at spotting this lack of innovation and weak value proposition. They will not pay a premium for a re-issued bag with minor changes or a product from a brand with an unclear identity. For them, value is a direct calculation of design originality, quality, and brand coherence—a calculation many legacy brands are currently failing.

The Shift from "Face" to "Style"

Traditionally, luxury was about "mianzi" (face) – displaying social status and wealth through recognizable logos. This is evolving rapidly, especially among the post-90s and post-00s generations.

Luxury is now a tool for individual expression and self-reward. They are buying into an aesthetic and a lifestyle that reflects their personal identity, not just their bank account.

Logos are becoming less important than the designer's vision. This is why the creative director's identity and the coherence of their "world" are so crucial. They are buying into Jonathan Anderson's quirky intellect or Demna's subversive edge, not just a Dior or Gucci logo.

The Experiential and Socially Integrated Journey

The purchase is just one part of the journey. The entire process—from discovering the product online, to sharing it with their community, to the "unboxing" experience—must be photogenic, shareable, and immersive. Luxury is a form of social currency and content creation.

The Chinese Market Landscape: A Brutal Arena for Brands

The Chinese market is acting as a brutal but effective filter. It is accelerating the success of brands that understand the new rules of engagement (like Dior with Anderson) and ruthlessly punishing those that are slow, inconsistent, or fail to provide a compelling value proposition (like Burberry).

In essence, the creative director musical chairs are, in large part, a desperate search for a figure who can crack the code of the modern Chinese luxury consumer: a consumer who is informed, fickle, expressive, and holds all the power.

The "Revenge Spending" Hangover: After China's strict zero-COVID policy ended, there was a brief period of "revenge spending" where pent-up demand exploded. That surge has now fully dissipated, revealing the underlying economic anxieties. Consumer confidence is fragile, making them more selective than ever.

The Price Parity Problem: For years, Chinese consumers did their luxury shopping abroad or through daigou (personal shoppers) to avoid hefty price premiums at home (which can be 20-40% higher due to tariffs and taxes). Brands have worked to close this gap, but the perception remains. In a downturn, this price sensitivity is magnified. If a brand isn't perceived as offering unique value, Chinese consumers will simply wait or not buy at all.

The Digital Ecosystem is Non-Negotiable: A brand's presence on Tmall, JD.com, Xiaohongshu, and WeChat is not an add-on; it is its central nervous system. The launch of a new collection is a digitally-native event. A misstep in digital marketing—or worse, being absent—means irrelevance.

Geopolitical Sensitivities: Brands must navigate a complex political landscape. A misstep related to national sovereignty (e.g., mislabeling Taiwan or Xinjiang) or a perception of disrespect towards Chinese culture can lead to immediate boycotts and the deletion of a brand from the Chinese digital sphere overnight. This adds a layer of risk that doesn't exist in other markets.

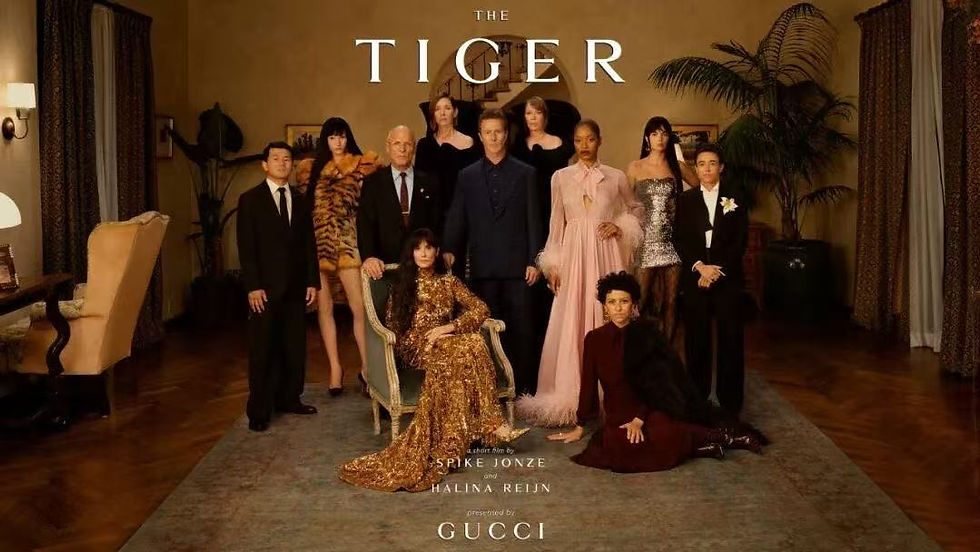

Image: The Tiger, Presented by Gucci 2026

How These Pressures Manifest in the Creative Director Appointments

The industry's response to this crisis has crystallized into three clear, and telling, strategic archetypes.

Gucci: Shock Therapy: For Kering, Gucci’s performance is existential. The appointment of Demna is not a strategic evolution; it is a calculated act of creative arson. They are torching the subdued elegance of his predecessor for the guaranteed, internet-breaking spectacle of a known disruptor. This is a high-wire act: can Demna’s avant-garde, streetwear-inflected vision captivate the masses and justify Gucci’s price point, or will it alienate the core clientele? The subsequent stock drop suggests investors fear the latter.

Dior: The Strategic Pivot: LVMH, from a position of immense strength, has executed a masterstroke with Jonathan Anderson. His genius lies in his ability to be all things to all people—or at least, to several key tribes at once. He offers intellectual heft for the art crowd, commercial wearability for the mainstream, and respectful nods to heritage (like the logo change) for traditionalists. It is a strategy of intelligent, inclusive evolution, designed to defend Dior’s massive scale while injecting it with new creative energy.

Burberry: Cautionary Tale: Burberry’s recent history is a textbook example of how not to manage a transition. The Daniel Lee era was marked by an undefined new "Britishness," products criticized as "mediocre," and commercially suicidal price hikes. The consequence was a catastrophic loss of brand equity, forcing the house to dump inventory at staggering discounts—the ultimate sin in luxury. It underscores a fundamental truth: no amount of marketing can save a weak product.

Image: Chanel Spring-Summer 2026 fashion show by Matthieu Blazy

Matthieu Blazy at Chanel: The Appointment of an Anti-Celebrity in the Age of Hype

Chanel’s appointment of Matthieu Blazy is the most significant and counter-cultural move in recent luxury history. While competitors chase viral moments and designer celebrity, Chanel has made a profound statement: the future of luxury is substance, not spectacle. This isn't just a new creative director; it's a strategic bet on a new set of values for the industry.

The Rejection of the "Superstar" Model for the "Substance" Model

The industry is obsessed with the celebrity creative director. Demna at Gucci is the story. Jonathan Anderson is a cultural figure represented by a Hollywood talent agency. In this context, the most rebellious thing Chanel could do was appoint an anti-celebrity.

The "Hedi Slimane" Alternative: The expected, flashier choice was Hedi Slimane—a designer known for his radical, all-encompassing, and personally branded revolutions. By choosing Blazy over Slimane, Chanel explicitly rejected the "genius dictator" model.

A Different Kind of Fame: Blazy’s potential celebrity will be built on intellectual and aesthetic complexity. This is a fame earned not by personal branding, but by respect for craft. It’s a deliberate pivot away from the "excess and ridicule" of influencer culture and toward a more serious, substantial foundation.

Blazy as the Embodiment of a New European Luxury Idealism

Chanel is positioning itself not just as a brand, but as a standard-bearer for a specific European ideal. In a world of "musical chairs" and frantic aesthetic shifts, this is a promise of stability. It’s a direct critique of the industry's splintering identity and a return to core principles. Blazy, with his deep focus on the Métiers d’Art and "creativity applied to craftsmanship," is the perfect vessel for this message. He doesn't just use artisans; he speaks their language.

The Aesthetic Vision: From Ornate Femininity to Intellectual Austerity

Blazy’s debut confirmed the thesis. His work is not a rejection of Chanel's codes, but a purification of them.

Restoring "Original Austerity": The show brilliantly identifies the tension Blazy wants to exploit: Coco Chanel’s "masculine and austere edge" versus the sometimes "overly ornate" femininity of recent years. His boyish shirts, tailored trousers, and fluid tweeds are a direct engagement with the founder's progressive, utilitarian spirit. Blazy's mission is clear: to create objects of such intelligent craftsmanship that they transcend seasonal trends and become enduring symbols of value.

The luxury industry is at a crossroads. One path leads toward ever-more-extreme hype, designer celebrity, and fleeting relevance. The other leads back to craftsmanship, heritage, and substance.

With Matthieu Blazy, Chanel has unequivocally chosen the second path. They have not hired a marketer or a hype-man. They have hired a custodian-philosopher—a designer who believes in the "rigor" of the process and the "consistency" of the product. For investors and industry observers, this is a bet on long-term brand equity over short-term buzz. It’s a declaration that while other brands chase the Chinese "here and now" or the American thirst for celebrity, Chanel will build its future on a foundation that is unshakably European, deeply cultured, and built to last.

In the chaotic symphony of fashion month, Blazy’s Chanel debut was the sound of a quiet, confident, and profoundly serious note. It may not have been the loudest, but it is the one that will resonate the longest.

The New Luxury Landscape

The diagnosis is clear: the industry’s addiction to hype, celebrity, and perpetual expansion has led to a crisis of value and identity. The cure requires a fundamental return to the core principles of luxury: exceptional product, clear identity, and deep customer connection.

The winners will be the brands that stop chasing every consumer trend and instead build a deep, authentic, and focused world that a specific clientele is willing to pay a premium for. The musical chairs are just the beginning; the real reckoning is just getting started.

Comments